The inflation is crazy, wonder when it will be the peak.

There are more and more stay at home mommies (SAHM) look for business opportunities while juggling between career and family. No, I am not creating stress to any mommy, I am a SAHM too so I know by heart how a mommy’s daily schedule looks like. It’s just that everyone has different level of stress tolerances. I am not an excellent player, I just want to start something now so I have a clearer directions by the time both of my girls go to school.

I speak for DR’s Secret skincare products as you may have noticed, here I would like to extend my great appreciation to my customers/friends again so I can still earn some side income from BWL. Not a huge figure, but it is definitely a bonus for a SAHM, at least I do not quite feel the financial stresses at this hard time. Of course, earning the more the better, just do not stop learning. So I utilize my “me time” exploring something else, and I have just got my freelance business registered a couple of months ago, the process is still fresh in my mind.

I studied The Malaysian Institute of Chartered Secretaries and Administrators (MAICSA) in Tunku Abdul Rahman College, which is now a University College. I was not a distinct student back then but I did put it into practice as an assistant handling not less than 100 client profiles in Singapore a decade ago. The business & company formation process in Malaysia is identical as the one in Singapore as we are sharing the same legal origin as former British colonies.

Anyone meeting the criteria below is eligible to register your business with Suruhanjaya Syarikat Malaysia (SSM):

- 18 years old or above

- A resident/PR of Malaysia

- Not disqualified or deemed ineligible for the role of the director

SECTION 198: PERSONS DISQUALIFIED FROM BEING A DIRECTOR.

(1) A person shall not hold office as a director of a company or whether directly or Indirectly be concerned with or takes part in the management of a company , if the person-

(a) Is an undischarged bankrupt

(b) Has been convicted of an offence relating to the promotion, formation or management of a corporation.

(c) Has been convicted of an offence involving bribery fraud or dishonesty

(d) Has been convicted of an offence under sections 213,217,218,228 and 539

(e) Has been disqualified by the Court under section 199

(2) The circumstances referred to in paragraph (1)(a), (b), (c) and (d) shall be applicable to circumstances in or outside Malaysia.

(3) Notwithstanding subsection (1), a person who has been disqualified under paragraph (1)(a) may be appointed or hold office as a director with the leave of-

(a) The official Receiver or

(b) The Court provided that a notice of intention to apply for leave has been served on the Official Receiver and the Official Receiver is heard on the application.

(4) Notwithstanding subsection (1), a person who has been disqualified under paragraph

(1)(b),(c),(d) or (e) may be re-appointed or hold office as a director with the leave of the Court.

(5) A person intending to apply for a leave of the Court under paragraph (3)(b) or subsection(4) shall-

(a) Give the Registrar a notice of not less than fourteen days of the person’s intention to do so and

(b) Make the Registrar a party to the proceedings under subsection (3)

(6) For the purposes of subsection (5), any person referred to in paragraph (1)(b), (c), (d) or (e) shall not be required to obtain a leave from Court after the expiry of five years calculated from the date he is convicted or if he is sentenced to imprisonment from the date of his release from prison.

(7) Any person who contravenes this section commits an offence and shall, on conviction, be liable to imprisonment for a term not exceeding five years or to a fine not exceeding one million ringgit or to both.

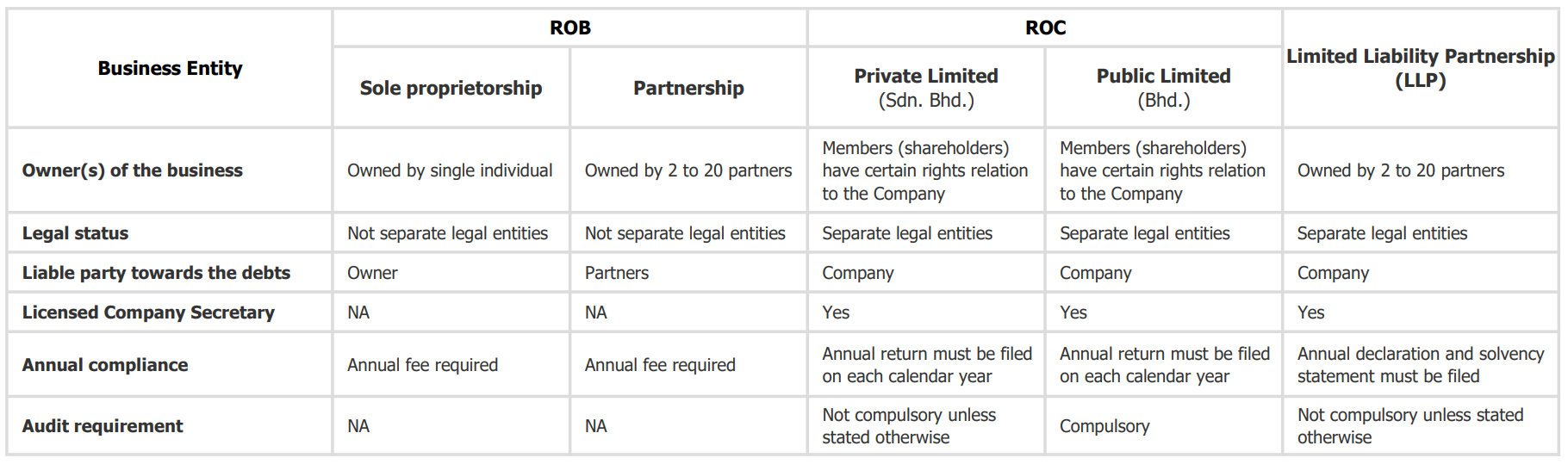

If you are clueless on which form of business entity to start up with, you may want to have a quick glance on the differences of each business category, ie Registration of Business (ROB), Registration of Company (ROC), and Limited Liability of Partnership (LLP) as follows:

I am writing this to share the procedures on Registration of Sole Proprietorship and Partnership businesses only, as the owners/partners are required to personally lodge the registration with SSM. If you are planning, or still thinking whether to start a small business from home, on your own or with partner(s), hopefully you can stop scratching your head after reading. By the way this is the easiest and most inexpensive way to start a business.

If you are looking for information to register a Private Limited (Sdn Bhd) or Public Limited (Bhd) company, please consult a licensed Company Secretary. You may do the research on your own and register a company all by yourself, but your company is still required to appoint a Company Secretary within 30 days after incorporation.

In fact not only Company Secretary, you will have a higher level of commitment to engage a tax agent and probably a certified auditor on monthly or yearly basis depending on their service packages as well, but the best part is that you and your company are separate legal entities so touch wood, if the company is sued, goes into debt or goes bankrupt, your personal assets will NOT be at risk.

Okay, let’s get back to the point on How to register Sole Proprietorship/Partnership with SSM.

Step 1: Be Prepared

Note down your proposed business name(s), partner’s details (for Partnership only), branch(es) information if any, together with your business information.

There are two types of business name:

Personal Name (RM30 Annual Fee)

This is the name in the identity card, which does not need SSM’s approval.

Trade Name (RM60 Annual Fee)

This is a business name that we must obtain prior approval from SSM.

Previously we had to submit Form PNA 42 with three proposed business names according to our priority for SSM’s approval, but “thanks” to COVID-19 our government simplified the process so much to ease the registration.

Omission of Form PNA 42 can now be a drawback as it may slightly delay the name approval process. So if possible, get ready more than one business name so you do not waste much time to rethink for next one in case first proposal is being rejected.

Step 2: Register as EzBiz User

Next is to sign up for an EZBIZ account at SSM Official Website by following this detailed Guideline for EZBIZ User Account Registration with screenshots provided by SSM, before you can register your business online.

In the past the verification could only be done at the SSM counters, but not to worry as you can now submit Appointment Form (only available in Malay language) to activate it via Whatsapp Videocall, without stepping out from home anymore. Such a hassle-free huh!

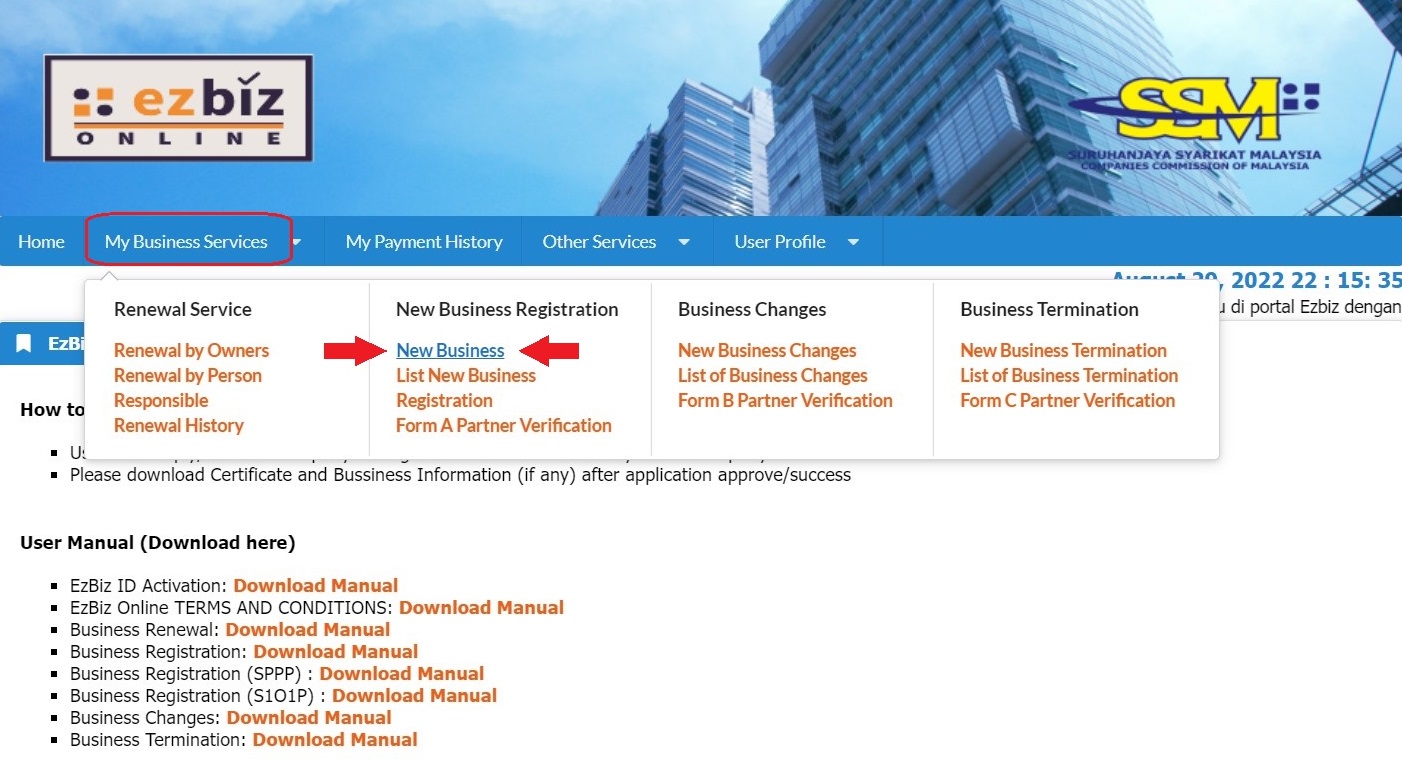

Step 3: Register Your Business via EzBiz

Once your EzBiz account is activated, it’s time to get down to the nitty-gritty of business registration.

Forget about the hardcopies, just log in to EzBiz then go to My Business Services tab, and click on New Business as shown below:

Complete Form A (screenshots attached below for your easy reference):

| Description | |

|---|---|

| Name Type | Personal / Trade |

| Business Name | Refer here (Ignore Procedure) |

| Business Start Date | Either ONE month before registration of business / current date |

| Partnership Agreement Date | For Partnership only |

| Incentive (Usahawan B40 / Pelajar IPT / OKU) | NA / S1O1P / SPPP SSM |

| Registration Period | 1 / 2 / 3 / 4 / 5 Years |

| Business Info | Yes / No |

| Status | Data Entry (Default) |

| Branches | Yes / No |

| Online Seller | Yes (Business Code 47912 added by Default) No (Business Code to be added) |

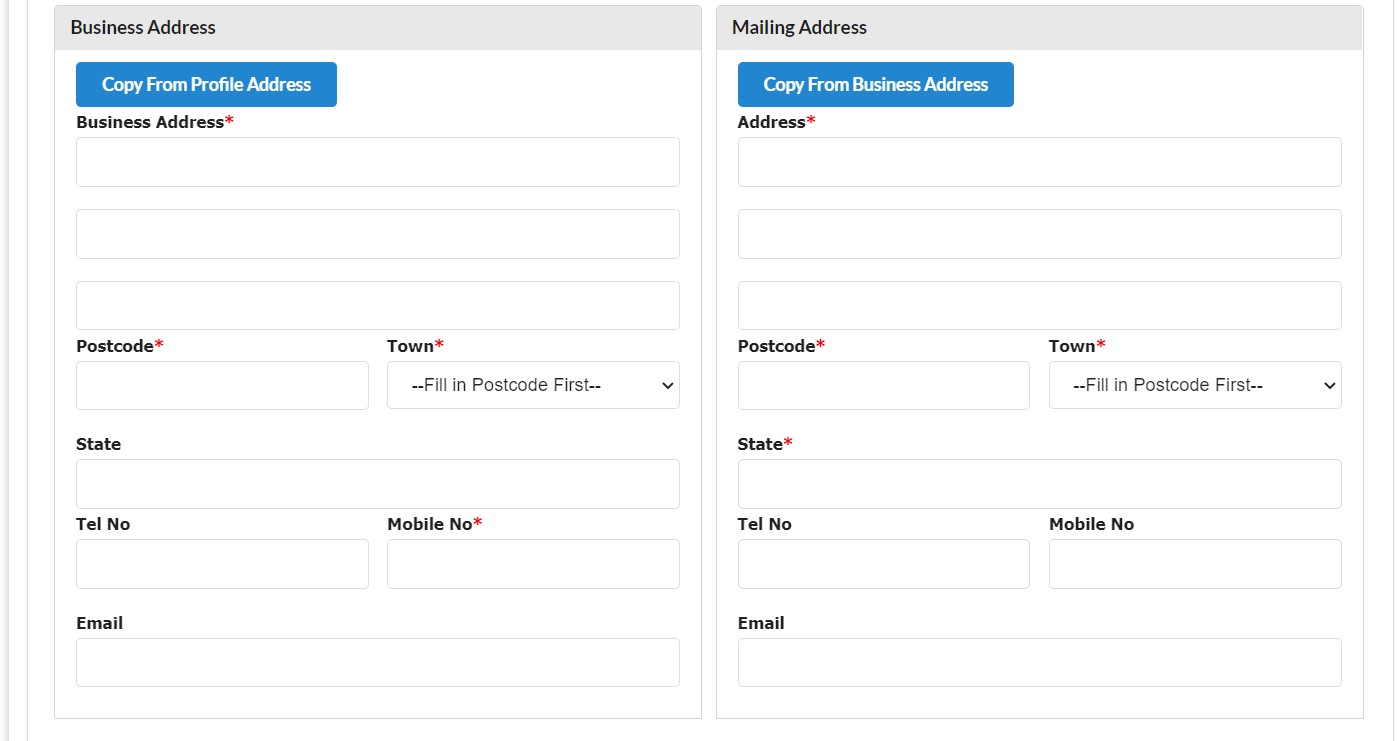

| Business Address | Home address |

| Mailing Address | Home address |

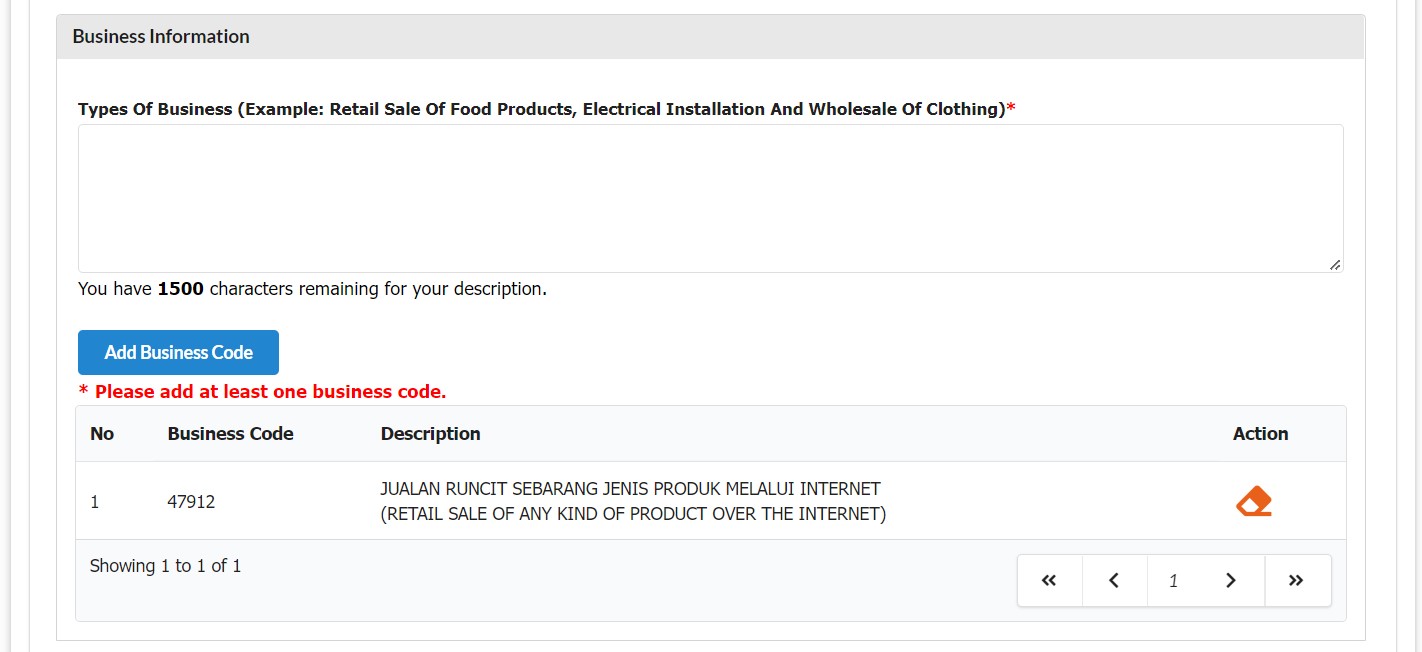

| Types of Business | A brief description about your business |

| Business Code | By default for online seller. Refer to MSIC for other businesses. |

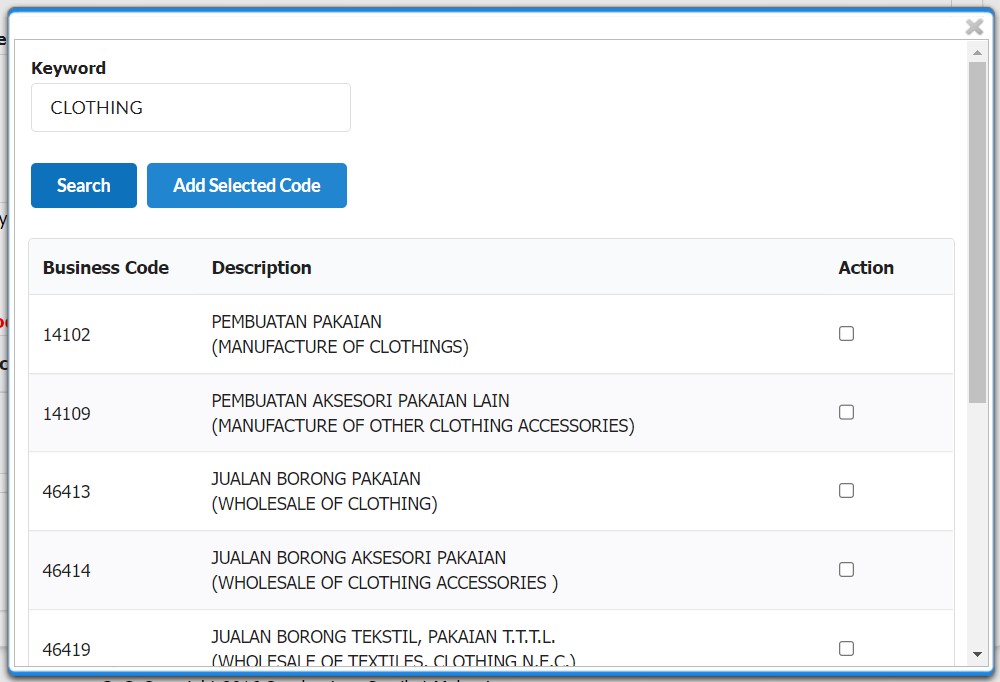

| Keyword(s) | Insert keyword to search for your business code(s) then add the selection(s) |

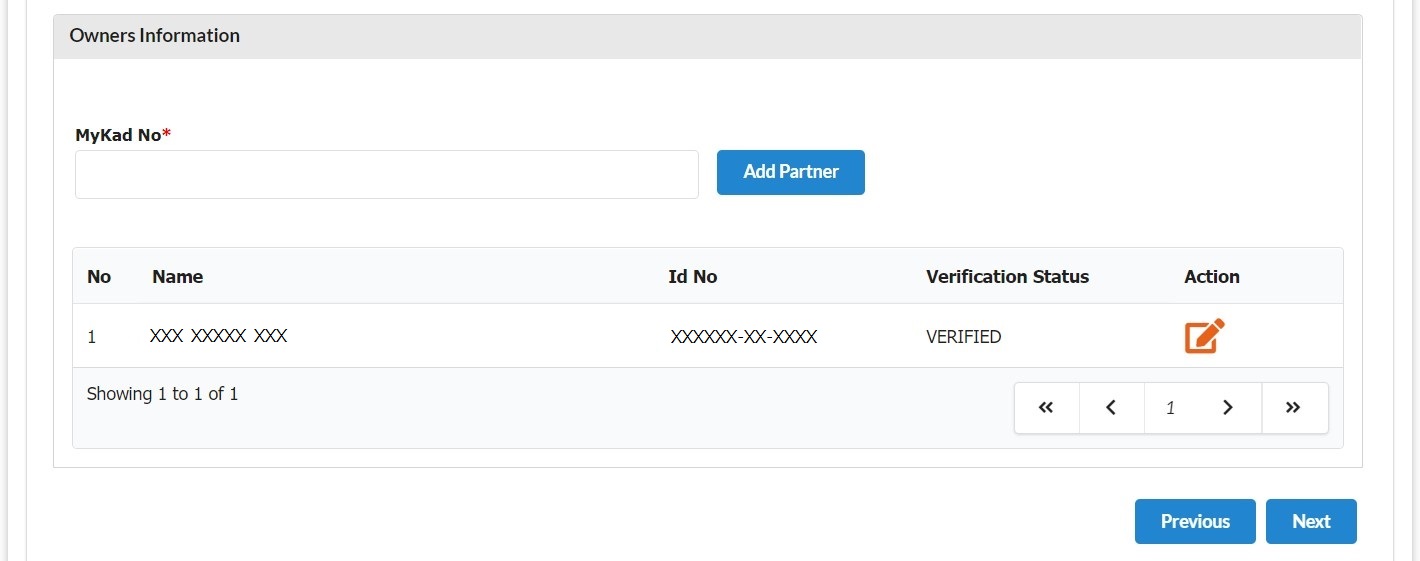

| Owners Information | For Partnership only |

Step 4: Submit & Pay

For 1-year of Sole Proprietorship with Trade Name, without branch, the amount you’ll have to pay is as follows, including the purchase of Business Info:

Within 24 hours, I received the approval from SSM, I have to say I was quite surprised with SSM’s efficiency. You may want to download and keep all the documents (Maklumat Perniagaan, Maklumat Pemilik Perniagaan Terkini, Form A and Borang D) in a folder for easy reference later.

Last but not least, let me just share with you my own experience on business bank account opening with Maybank. You may skip this if you are planning to have yours in other banks.

Apply SME First Account with Maybank here without Introducer online, the account will be created almost immediately. You will be given a bank account no. but you need to try making appointment with Maybank via EzyQ before you head to the bank or just walk-in to get the account activated.

These are the documents required for account activation:

- Identity card of the proprietor/all partners and authorised signatories (if any)

- Mandate Letter (if any)

- Certificate of Business Registration

- Form D (Business License)

- Deed of Partnership (for Partnership only)

- Initial deposit of RM1,000 (upon opening of account)

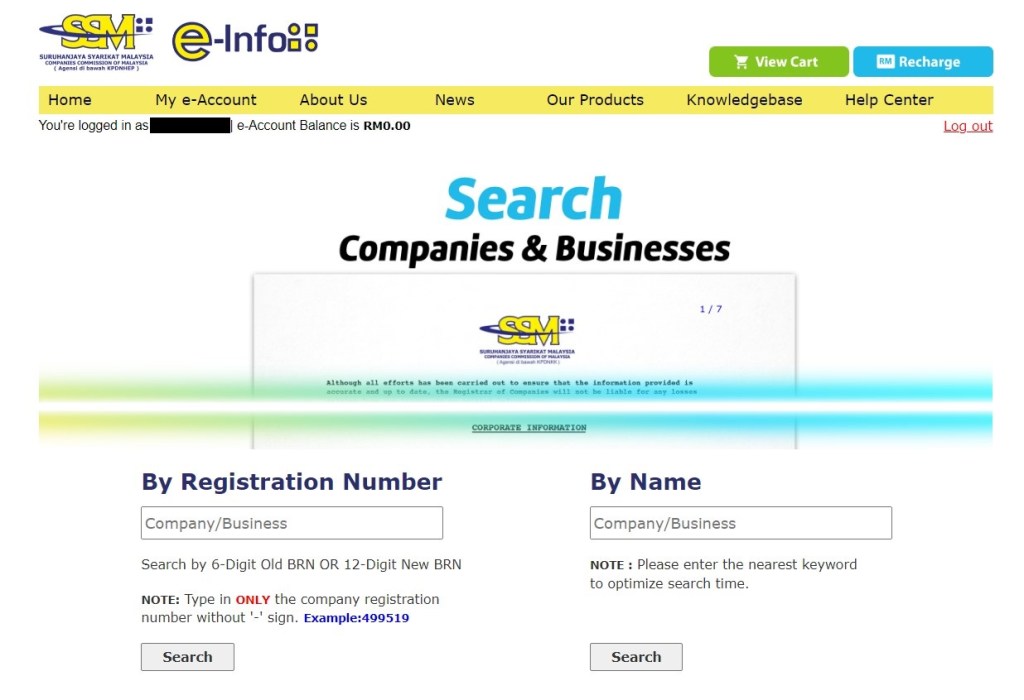

Final tip from me: You may sign up and log in to SSM e-Info to narrow down your business name options, it shows you the existing business/companies’ name.

I may have missed out some details, please feel free to ask me in the comment section if you cannot find certain information regarding the registration of Sole Proprietorship & Partnership.

Thank you for reading and Good Luck to you!!